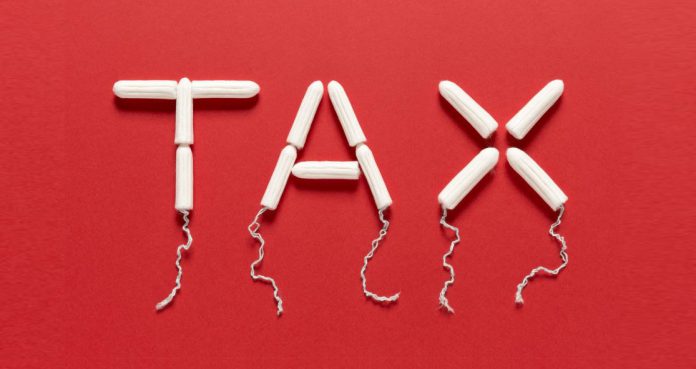

California is one of the 35 states that imposes an unfair amount of tax on menstrual health products. The California law considers menstrual health products non-essential goods.

Every year, women who menstruate have to spend $20 million in taxes on menstrual hygiene products in the state of California alone. The Sales and Use Tax Law of California requires sales tax on every retail product. Meanwhile, food, medicines, including Viagra, and other medical supplies are sold in California without sales tax.

When menstrual hygiene products are taxed and Viagra is not, it propels an appalling message about our California’s values.

Lily Conable, the Student Member of the Alameda Unified School District Board of Education, wrote a letter stating:

“As a high school student, I’ve witnessed how this tax disproportionately impacts marginalized groups — including young people. Students are frustrated with the already-high cost of period products and it’s clear that menstruating individuals, especially those still in school, shouldn’t have to worry about being able to have basic necessities.”

She also wrote, “Equitable access to these products is crucial. I ask that you join me in calling your state assembly member and senator, and asking them to advance AB31: a bill exempting tampons, sanitary napkins, menstrual sponges, and menstrual cups from sales tax.”

Further, she said, “We need to end this unjust practice by passing Assembly Bill 31 in the California Legislature.”

California residents who have periods and use menstrual hygiene products are taxed at 7.25%, with the insinuation being menstrual hygiene is a luxury. There is no denying that a lot of pressure this tax will impose on those who have periods and lack adequate income, with 14.3% of Californians living in poverty.